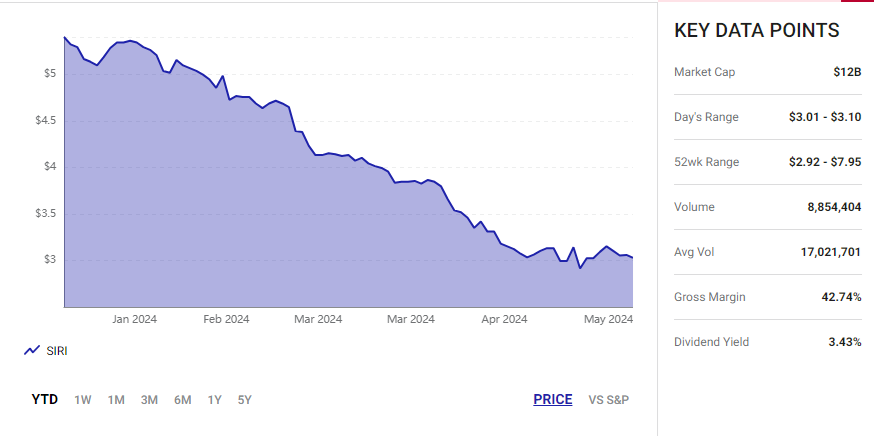

Warren Buffett has a large position in Sirius XM, which is down 44% so far this year.

Warren Buffett is one of the most well-known investors in history. The Oracle of Omaha has made a fortune in the stock market, but Buffett’s investing strategy is actually really simple.

Buffett invests in blue-chip companies that generate strong, predictable cash flow. Some of the largest positions in Berkshire Hathaway‘s stock portfolio include Apple, American Express, and Coca-Cola.

One company that you may be less familiar with that’s also part of the portfolio is streaming service Sirius XM (SIRI -0.98%). With approximately 33 million subscribers, Sirius XM operates the largest satellite radio platform in North America.

Despite the company’s predictable subscription-based revenue model and consistent operating profits, shares in Sirius have fallen 43% so far this year.

Is now an opportunity to buy the dip in Sirius stock? Let’s find out.

Sirius XM’s business model looks strong

One of the biggest selling points regarding an investment in Sirius is the company’s business model. Most radio stations thrive on deals with advertisers. However, similar to other streaming entertainment businesses, the majority of Sirius’ revenue comes from subscribers.

This dynamic provides Sirius with a good deal of pricing power. Moreover, considering the company’s channel lineup includes several radio personalities and content creators exclusive to Sirius, there is an inherent demand to access the platform.

Some moves by management don’t appear to be paying off

At the end of 2019, Sirius boasted 34.9 million subscribers. However, just two years later at the end of 2021, the company had lost nearly 900,000 subscribers.

A high level of churn during these periods was natural. Between 2020 and 2021, the COVID-19 pandemic was in full swing.

As a result, working from home became more mainstream — leaving a service such as Sirius somewhat unnecessary. Considering far fewer people were commuting to and from an office on a daily basis, many subscribers opted to cancel their contract with Sirius.

Over the last couple of years, Sirius has spent hundreds of millions of dollars acquiring exclusive rights to podcasts from celebrities, including Conan O’Brien and Jason Bateman. While Sirius has done a great job building out its entertainment library, these efforts look disconnected from the actual operating results of the business.

At the end of 2023, Sirius had 33.9 million subscribers. Per the company’s first-quarter 2024 earnings release, Sirius lost another 359,000 subscribers during the first three months of the year.

Should you buy the dip in Sirius XM?

The chart below benchmarks Sirius against other leading streaming services on a price-to-sales (P/S) basis. At a P/S of just 1.3, Sirius is the lowest-valued stock in the peer set based on this valuation metric.

Per the company’s first-quarter earnings release, management is calling for revenue of $8.7 billion and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $2.7 billion in 2024. Both of these forecasts are considerably lower compared to how the company performed in 2023.

If you’re interested in the streaming landscape, there are far more established players, such as Netflix, Spotify, or Roku. With that said, I’d be remiss not to mention that each of those providers has also experienced its share of challenges in the streaming realm.

To me, probably the safest opportunities in streaming are Apple, Amazon, and Alphabet. All of these companies have successfully entered the streaming landscape without compromising their existing dominant businesses in consumer hardware, e-commerce, cloud computing, and advertising. In fact, entering streaming has helped complement their other segments while diversifying their respective overall businesses.

Given Sirius stock is trading at a steep discount relative to its peers, you might think now is a time to take advantage of the price disparity. However, I think this is shortsighted and see Sirius as too much of a gamble right now.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.